Hotel brand managers need to issue much stricter brand guidelines to affiliates and channel partners. That’s the message from a recent study by MarkMonitor, who estimate the U.S. hotel industry is losing an $1.9 billion annually in online bookings.

Before alarm bells start ringing, let me underline that nothing illegal is going on here.

Brandjacking

Competitive brandjacking is a problem which affects almost every strong online market, particularly where there is a complex web of channel and affiliate partners. The relationship between a brand and it’s channel partners is symbiotic in nature and aimed at reducing marketing costs for hotels, whilst increasing reach, and in so doing, squeeze more profit. In return for channel partners bearing the risk of actual marketing costs, they get to leverage the trust and recognition of being a partner with these well known brands. Affiliate and channel partners earn commission or profit from reduced price on rooms.

Most of the time, brands and channel partners play together nicely and the latter mop up the opportunities missed by the core brand, particularly in the long tail of search. However, the MarkMonitor report shows that hotel brands are becoming a victim of their own success, as channel partners have effectively started competing against them for their own customers.

In particular, channel partners are bidding on brand search terms, pushing up prices for hotels to attract direct customers, and in some cases, even using brand search traffic to redirect customers to alternative hotels. The upshot is that hotels are paying out on unnecessary commissions.

Offending Tactics

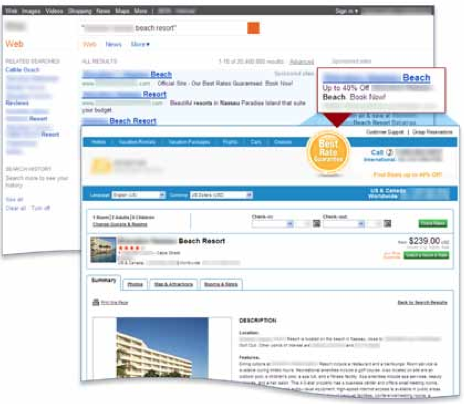

In the example below, taken from the report, we can see that the top ad position for a search of a hotel brand in Atlanta faces a full suite of competition. However, one would expect to see just one ad at the top of that search. Try it yourself and nearly every major hotel chain and destination has the full complement of competitors, all of whom are pushing the cost-per-click up for the hotel, whilst taking commissions for any customer they convert. Given that the customer used the hotel brand name and destination in their keyword search, one could fairly extrapollate their intent was to book directly with the hotel.

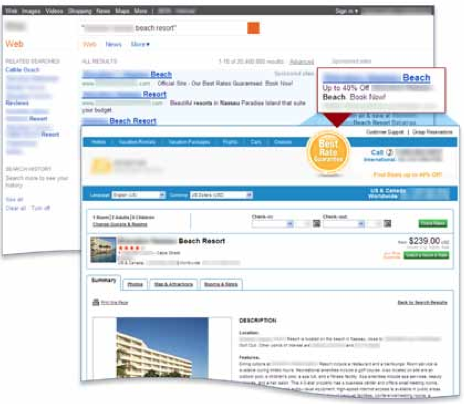

In this second example from the report, we can see that a hotel deals aggregator is advertising on branded keywords and whilst directing users to the correct landing page, is also making suggestions for other hotels in the area. In effect, the hotel brand is unwittingly allowing other brands to piggy back off it’s reputation. Again, in my own investigation I came across many landing pages that made suggestions for similar price range hotels and even used AdSense ads to direct traffic elsewhere and again, effectively draw revenue from the hotel’s reputation.

Is it Google’s Fault?

Whilst there is a lot of discussion about the fairness of allowing competitors to bid on your brand terms, Google is effectively a marketplace and so like any other marketplace is expected to offer a wide range of choices. Google should not need to police this for brands. Also, to be fair, Google has a good record in honoring trademark infringements put forward by advertisers.

Furthermore, the case becomes muddied by the fact that these ‘competitor ads’ are actually from partners! With that in mind, the responsibility for marketing budget inefficiency lies squarely with hotel brand managers. In fact, MarkMonitor found that Online Travel Agents accounted for nearly half of all the advertisers on branded terms and alsmot 80% of ad placements. Meanwhile competitors made up the other half of bidders, but only accounted for 6% of the ads placed.

The irony is that most brand managers will be oblivious to the opportunity cost because they have actually been a victim of their own success in search. The leisure travel industry spends $1.8 billion annually in online advertising, with 46 percent allocated to search advertising, according to the Internet Advertising Bureau (IAB). Online bookings grew from 33% of all bookings in 2007 to 40% in 2010, and another quarter of total bookings are influenced by online customer research. Frankly everything looks pretty rosy.

Yet, do your own research and you will see that it’s not pretty. Whilst not directly related to the branded search term problem, hotel chains are also losing revenue or paying out commissions unecessarily to cybersquatters. This is nothing new but indicates how lucrative the channel business actually is. Also of note in the report was evidence that hotel employees were selling on their own discounted rates via Craiglist, whilst frequent guests were also found to be selling their loyalty points.

Nonetheless, from every crisis is an opportunity, and this problem is a great one for PPC agencies and hotel brand managers to grapple with.

How do you take the leadership role in protecting branded search term use by partners or affiliates?

Here’s a recommended process that many online brands are adopting:

- Examine marketing partner and affiliate contracts and work with your legal team to include provisions that spell out how your company’s brand terms can be used and what enforcement measures will be taken.

- If you don’t already have a database of your company’s branded terms, now is the time to create one. You will want to share this database with your affiliates and channel partners so they will know which branded terms are off limits for their use. Of course, the database will be subject to updates as your company adds additional brands or changes existing brands.

- Set up a formal online monitoring and enforcement process with the legal team to track misuse and take action according to the terms of your newly-revised contracts. Proactive monitoring should track the offenders, the terms, geographical markets and time of day when misuse occurs. There are a number of software applications available that automate this tracking process.

- Bring your social media manager into the conversation to identify how your efforts to protect your brand can complement each other and add to the overall online standing for your brand. As noted in a recent Search Engine Watch article by Lisa Buyer, ‘control your branded search results before there is a problem.’

- Become familiar with the process for reporting brand search term misuse to the major search engines. The responsibility for informing the search engines on abusive practices rests with the brand itself. Your monitoring program will identify instances of competitive ‘bait and switch’, which is actionable with the search engines.

- Consider creating ad landing page policy for channel partners that forbids offering contextual ads or suggestion alternative hotels.

- Be realistic about the usability and transaction path of your own website – could you be driving customers away because your site is too difficult to use?