In the ongoing cycle of market forecasting, we’re once again at a half-year refresh for mobile local ad revenue projections. Though the revenue outlook is the “money” number, there are lots of background inputs to dissect, such as mobile search volume.

Where is the Market Going?

Mobile local ad revenues will grow from $784 million last year to $5.01 billion in 2016. If that seems low, keep in mind that we’re just talking about the local segment of overall U.S. mobile ad revenues (further defined and explained here).

But to really get a sense of where these numbers are coming from, it’s best to break down their components. Specifically, we look at the ways that different ad formats are consumed, bought, and sold. These include search, display, SMS, and video ads.

The search portion is growing fastest, and is the biggest driver of overall growth in mobile advertising. This is partly due to the growth we project in the mobile web –where search is central – as opposed to apps (reasoning here).

But it’s also directly related to mobile user behavior in the form of mobile local search volume growth; and to higher performance we’re seeing from search ads, compared to other formats. That’s largely due to their pull based, intent-driven nature.

A Look Under the Hood

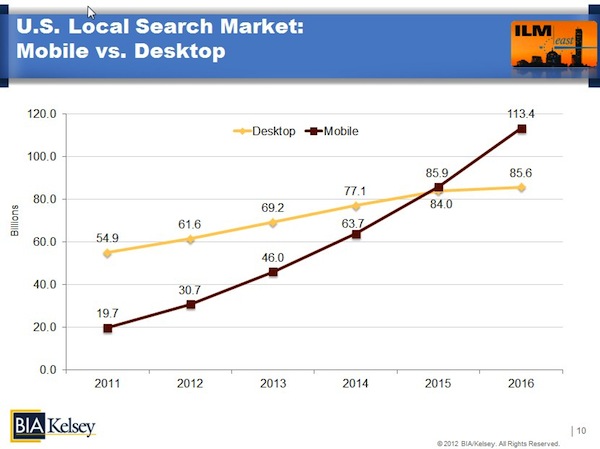

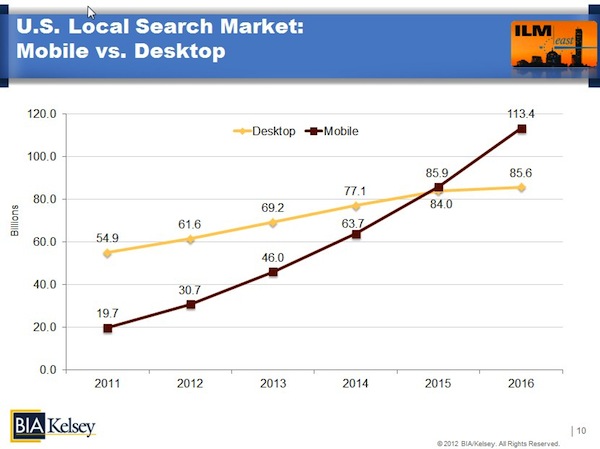

Let’s first look at mobile local search usage. After looking at assorted spreadsheets, projected mobile ad revenue figures, search query volume, and other inputs, it came time to compare desktop search volume. After plotting out the figures, something interesting emerged: mobile local search volume will intersect desktop local searches in 2015.

A lot of this has to do with mobile local searches per-user, growing from about 14 per month to 42 per month by 2016. But it’s also a function of the number of mobile search users – growing from 44 percent of U.S. smartphone subscribers (about 118 million users), to 75 percent by 2016 (225 million users).

The beauty of these figures is that Google’s ownership of mobile search (95 percent market share) makes its usage disclosures reliable in extrapolating the entire market. We know its monthly desktop query volume. We also know that 20 percent of searches are mobile, and 40 percent of those are local.

From that baseline, it’s a matter of projecting out to 2016, using other market inputs such as smartphone penetration. Meanwhile we can look to other points of affirmation such as trend lines indicating that overall web user volume will follow the same mobile/desktop intersection around 2015.

Demanding Action

Further boosting search’s share of mobile local ad revenue is the performance seen from location-targeted mobile search ads. Mobile local ad network xAd reports click-through rates (CTRs) for location-targeted in-app search ads at 7 percent (we get similar unpublished numbers from Google for mobile web searches).

That’s as high as a 10x performance boost compared to ads that aren’t location targeted. But more important is what is happening after the click. We’re seeing favorable metrics for what we call secondary actions (calls, directions, etc.) to the tune of about 37 percent of those clicks.

That’s obviously powerful stuff for advertisers – especially local – who are interested in driving such activity. The next step will be going further down the funnel into mobile payments, which clarify the path to conversion and reveal data to refine future presence/ad targeting (Google Wallet’s real end game).

This performance hasn’t led to the premium ad rates commensurate with their value, but that’s only because of laggard advertiser adoption that’s kept demand (and thus prices) low. But we believe premiums will follow, contributing to search’s share of the mobile local revenue pie.

Panning back, we should see mobile advertiser demand grow overall. Even if you don’t buy the above reasoning for mobile local search ad growth, look no further than the basic fact that mobile’s share of time spent per media is 23 percent, while it’s share of ad dollars is only 1 percent (compare with print advertising).

Natural forces of equilibrium will bring that mobile ad spend up considerably in the coming years. And local search ads – as they’re so conducive to mobile devices and the ways we use them – will see the biggest piece of that action.