Study: How ready are businesses for voice search?

A new analysis of 73,000 business listings found that 96% of all business locations fail to list their business information correctly.

A new analysis of 73,000 business listings found that 96% of all business locations fail to list their business information correctly.

“So… most businesses know about voice search. But has this knowledge helped them optimize for it?”

An interesting report recently released by Uberall sought to address that exact question. For as much as we talk about the importance of voice search, and even how to optimize for it — are people actually doing it?

In this report, researchers analyzed 73,000 business locations (using the Boston Metro area as their sample set), across 37 different voice search directories, as well as across SMBs, mid-market, and enterprise.

They looked at a number of factors including accuracy of address, business hours, phone number, name, website, and zip code, as well as accuracy across various voice search directories.

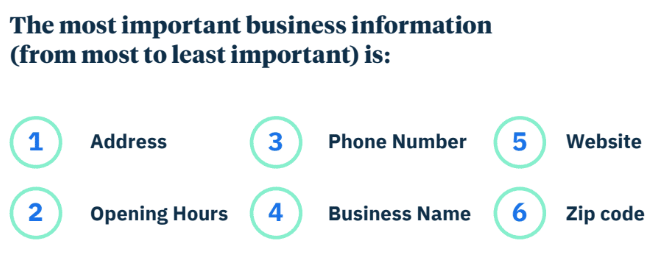

In order, this was how they weighted the importance of a listing’s information:

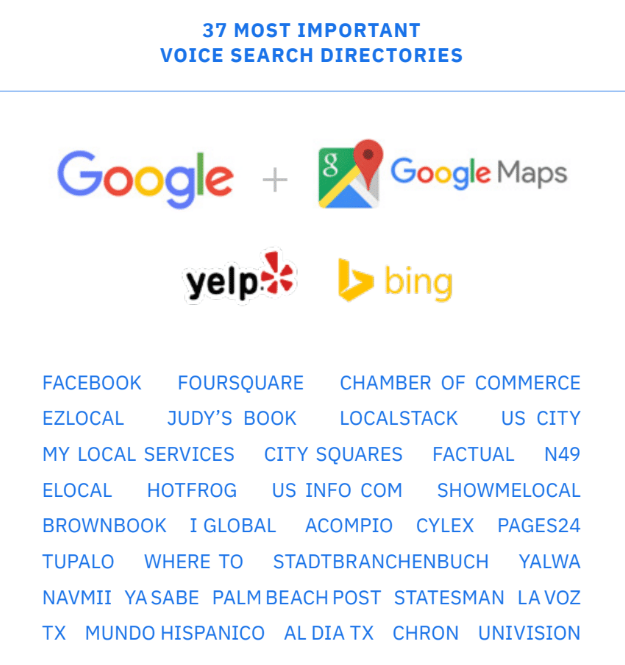

And pictured below are “the 37 most important voice search directories” that they accounted for.

Uberall analysts did note, however, that Google (search + maps), Yelp, and Bing together represent about 90% of the score’s weight.

The ultimate question. Here, we’ll dive into a few key findings from this report.

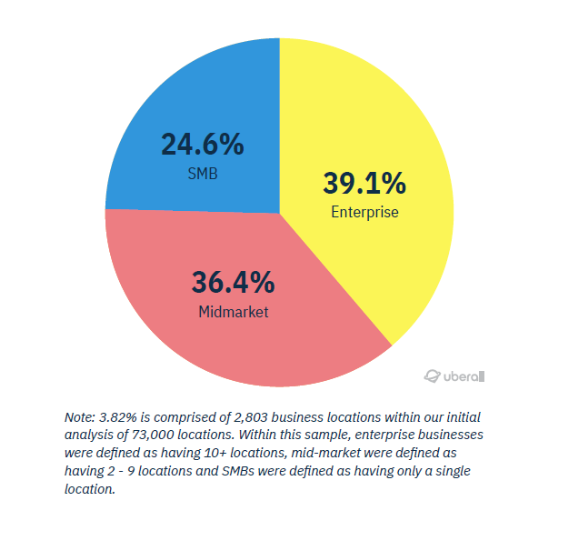

When looking just at the three primary listings locations (Google, Yelp, Bing), Uberall found that only 3.82% of business locations had no critical errors.

In other words, more than 96% of all business locations failed to list their business information correctly.

Breaking down those 3.82% of perfect business location listings, they were somewhat evenly split across enterprise, mid-market, and SMB, with enterprise having the largest share as one might expect.

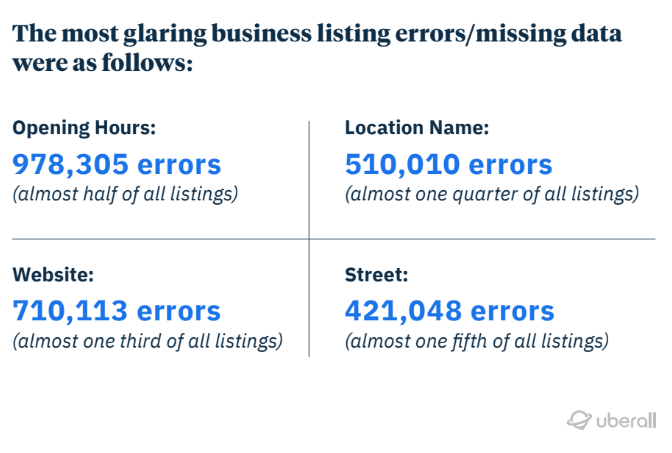

In their analysis, here’s the breakdown of most common types of missing or incorrect information:

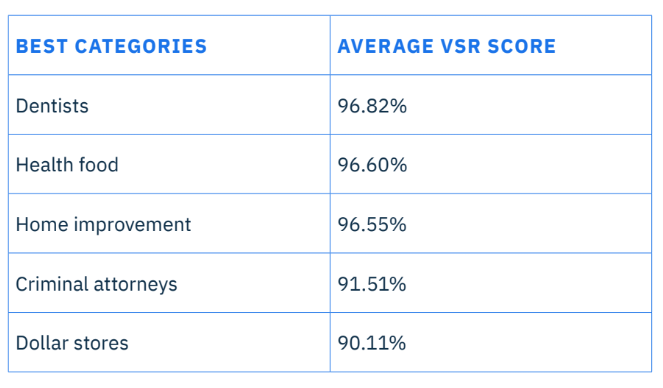

Industries that were found to be most voice search ready included:

Industries that were found to be least voice search ready included:

Not much surprise on the most-prepared industries relying heavily on people being able to find their physical locations. Perhaps a bit impressed that criminal attorneys landed so high on the list. Surprising that art galleries ranked second to last, but perhaps this helps explain decline in traffic of late.

And as ever, we can be expectedly disappointed by the technological savvy of congressional representatives.

The next question, of course, is: how much should we care? Uberall spent a nice bit of their report discussing statistics about the history of voice search, how much it’s used, and its predicted growth.

Interestingly, they also take a moment to fact check the popular “voice will be 50% of all search by 2020” statistic. Apparently, this was taken from an interview with Andrew Ng (co-founder of Coursera, formerly lead at both Google Brain and Baidu) and was originally referring to the growth of a combined voice and image search, specifically via Baidu in China.

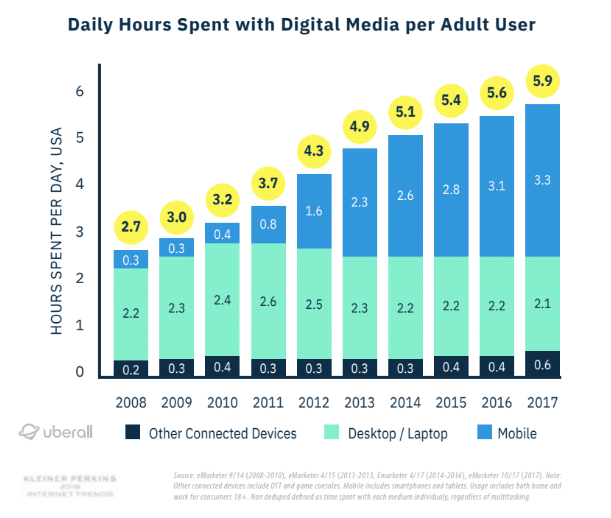

This data was compiled from a number of charts from eMarketer, showing overall increase in digital media use from 2008 to 2017 (and we can imagine is even higher now). Specifically, we see how most all of the growth is driven just from mobile.

The connection here, of course, is that mobile devices are one of the most popular devices for voice search, second only perhaps to smart home devices.

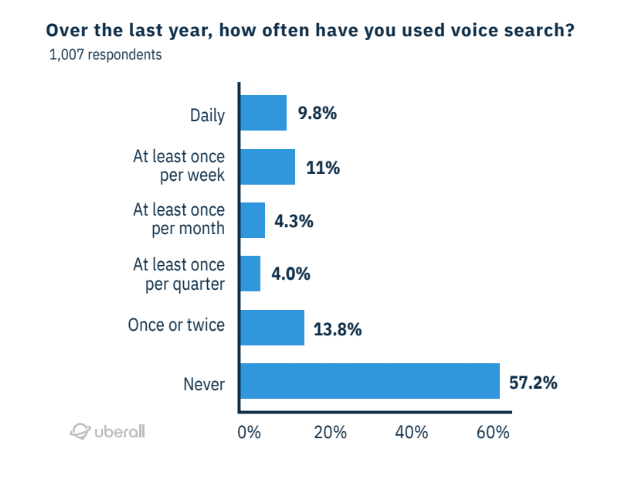

According to this study, 21% of respondents were using voice search every week. 57% of respondents said they never used voice search. And about 14% seem to have tried it once or twice and not looked back.

In general, it seems people are a bit polarized — either it’s a habit or it’s not.

Regardless, 21% is a sizable number of consumers (though we don’t have information about how many of those searches convert to purchases).

And it seems the number is on the rise: the recent report from voicebot.ai showed that smart speaker ownership grew by nearly 40% from 2018 to 2019, among US adults.

Overall, the cost of not being optimized for voice search may not be sky high yet. But at the same time, it’s probably never too soon to get your location listings in order and provide accurate information to consumers.