Over the past couple of weeks, paid search specialists Adthena have been sharing some fascinating insight into how the coronavirus pandemic is affecting the paid search sector in markets around the globe.

I spoke to Adthena’s VP of marketing Ashley Fletcher about the questions C-level executives are asking, their plans in the short and longer-term, and what he is observing in the data.

We’re past the shock stage

C-level executives now want to see the lay of the land amidst the coronavirus outbreak. Retailers, for instance, want a view of who’s moving out and many are asking:

- What’s happened to strategy?

- How are markets reacting?

- How do we now adjust?

Paid search is a fantastic window on all of this. While our offline lives have been massively disrupted by the coronavirus, the paid search sector is comparatively ever-present. We see customers switch to the channel when they can’t use others and we have good segmentation within data across products and more business verticals.

“Search intelligence offers not only remarkable clarity but also a real-time lens into market movements, trends, and opportunities across verticals and in close to real-time”,

Fletcher writes at the Adthena blog.

“PPC is a stable, transparent refuge every marketer needs to be leveraging right now to keep the oars in the water.”

There is positivity even in industries that have been hardest hit

One of the surprises for Fletcher is that the sentiment among marketers he is speaking to is not all doom and gloom.

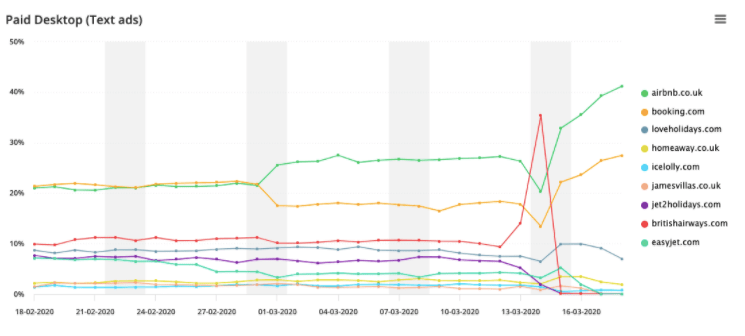

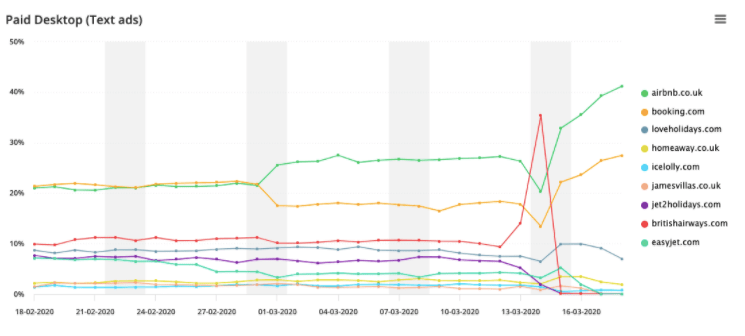

“Businesses like the UK travel sector (we’re seeing this with some of our hotel chain clients) have been the hardest hit. But the positive aspect of this is we are already seeing this sector with eyes on their recovery and looking at where they go next”,

Fletcher said.

“People are prepared to lower spend now, but are gearing up for coming out the other side.”

Data showing significant feats of agility

It is not only the travel sector which has had to change track quickly.

“In the food vertical, many brands have been seen to suspend some generic ads, but they are keeping the lights on for brand traffic”,

Fletcher said.

“Managers are coming to the paid search data asking: What’s my brand looking like while competition might be able to take more capacity?”

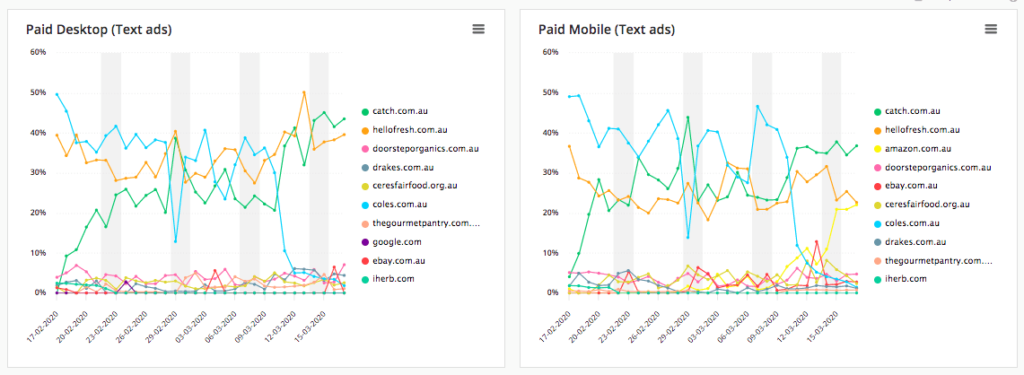

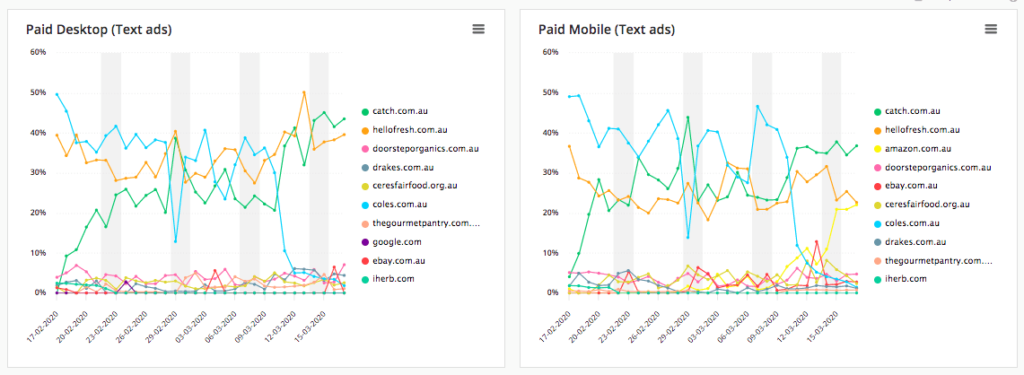

This is particularly visible as vast numbers of users seek to use delivery services offered by the likes of Tesco and Sainsbury’s in the UK, as well as Coles in Australia (see below).

Digital-first brands like Amazon, Catch, and Hello Fresh are jumping into the gaps created when the legacy supermarkets have quickly hit capacity for food grocery deliveries.

We can also see Amazon shifting paid ad priorities to essential products, which is creating further gaps. This means other companies like Best Buy have then been able to garner clicks for things Amazon has had the monopoly on till date – such as TVs, kitchenware, and mobile phones.

Fletcher is seeing this agility being demonstrated in other sectors too – from online banking to online betting.

Takeaways for digital marketers

The paid search sector gives us a fascinating glimpse into the disruption at play across the global business. But the positivity, agility, and resolve on display is heartening too.

The real-time data available to paid search marketers answer three key questions

- How consumer habits sometimes shift rapidly

- How their brands are retaining visibility in the melee

- How competitors are changing strategy and focus in order to adapt

In some cases, we can certainly see prices go up and clicks go down as users and brands change their ways. The flipside of this is that gaps and opportunities are opening up in surprising places as big names shift their focus to specific products and services. Smart marketers will be observing those gaps and acting on them.

Yet, the most important takeaway from Adthena’s data is a long-term strategy

Here in the UK and US, we may still be in the beginning stages of this global event, but while many businesses have been forced to make some quick near-term changes, some are already making plans as to what their priorities will be when coronavirus is behind them.

Marketers can expect that business and consumer habits may well be altered entirely, but in the very least the value of search and data will continue to be vital. In order to remain agile and competitive in the markets of tomorrow, it’s likely to become even more important.