Search advertising has swelled to become an industry worth over $35 billion annually, yet it is still heavily driven by text-based searches and dominated by Google.

However as Google’s index goes mobile-first, consumers get to grips with voice search, and technology advances to avail of image identification in our predominantly visual culture, new opportunities are opening up for the competition.

One such opportunity lies in the use of Google’s own Chrome web browser, which allows companies (including Google’s rivals) to develop and disseminate extensions to grow their digital footprint.

This may not necessitate or even facilitate a seismic shift in the industry, if Google continues to provide a search product that responds best to a user’s query.

Undoubtedly, Google remains the go-to location when consumers know what they want; but what if other providers could get in on the act earlier, by nudging consumers towards products they hadn’t thought of or never knew existed? What if consumers start to move away from text queries, and image or voice search become the norm?

These are the questions Amazon and Pinterest are pondering as they look to break Google’s hegemonic hold on the market. This has seen both companies launch paid search products, but something significant has to give if consumers are to switch from the well-worn habit of reaching out to Google first.

Intriguingly, recent moves suggest Amazon and Pinterest are prepared to use Google’s own Chrome platform to loosen the search giant’s iron grip on ad revenues, with what are at times aggressive tactics.

Although some commonalities exist across both challengers, there is much to distinguish them too. We’ll begin with Amazon’s Chrome extension before moving on to Pinterest’s recently-upgraded offering.

Amazon Assistant for Chrome

Amazon’s Assistant tracks users as they browse other sites and locates opportunities to alert them of better deals on the same product over at Amazon.com.

This feature looks something like this in action:

No doubt, this is an overbearing approach designed to have the maximum disruptive impact on a consumer’s experience, diverting their path to purchase towards the comfort of Amazon’s one-click purchases and free deliveries. And all at a lower price, too.

There are reports of some websites blocking the extension and, in the pettiest of cases, ensuring that low quality images of products are used when a consumer adds them to their Amazon wish list, in the hope of dissuading them from finishing the purchase there.

However, the damage may well be done by that stage. Digital consumers vote with their fingers, and people tend to follow where the best deals are.

Where this gets particularly fascinating for those of us in the search industry is when we apply this Chrome extension to Google search results pages.

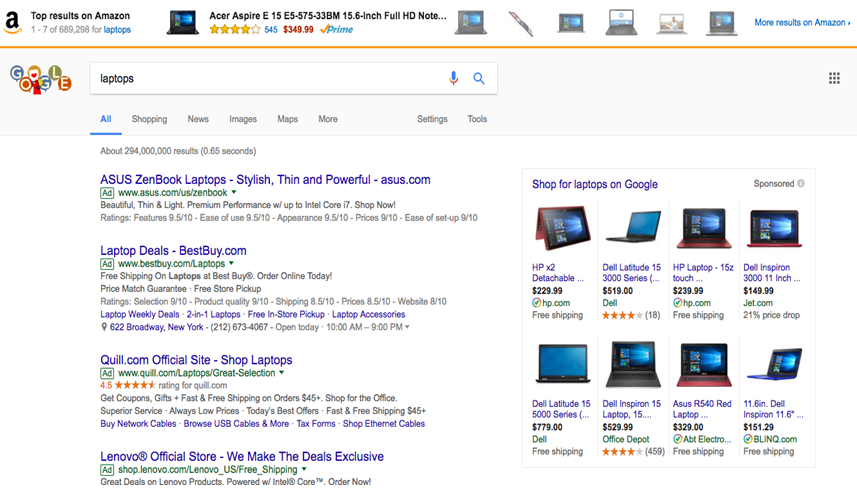

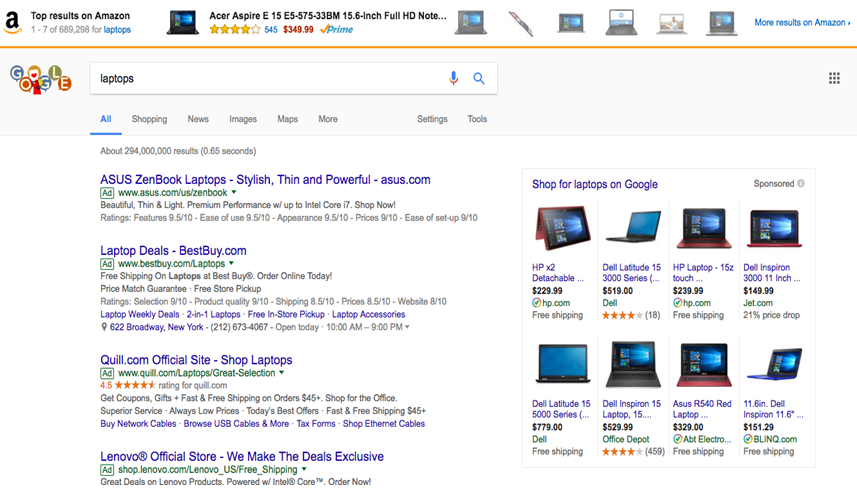

With the extension downloaded (I am based in the US), a clearly commercial query like [laptops] returns the following results:

Indeed, those are Amazon results at the very top of the page.

This very assertive approach sees Amazon encroach directly on Google’s owned space, in fact relegating them to a lower position.

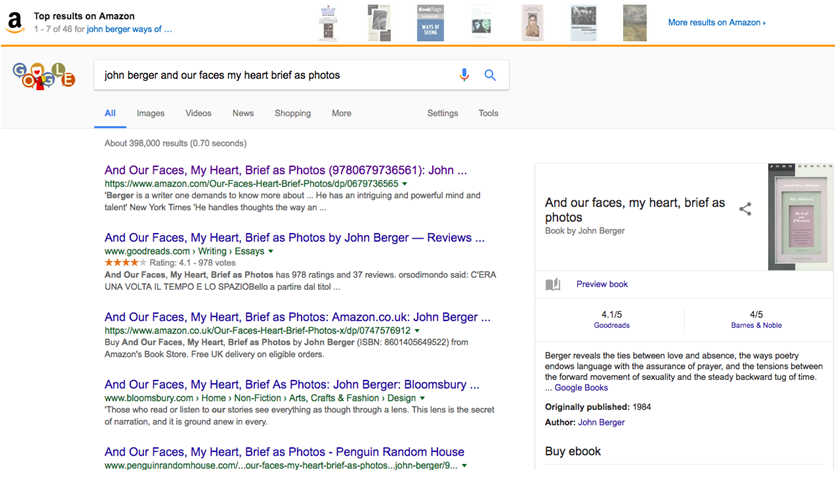

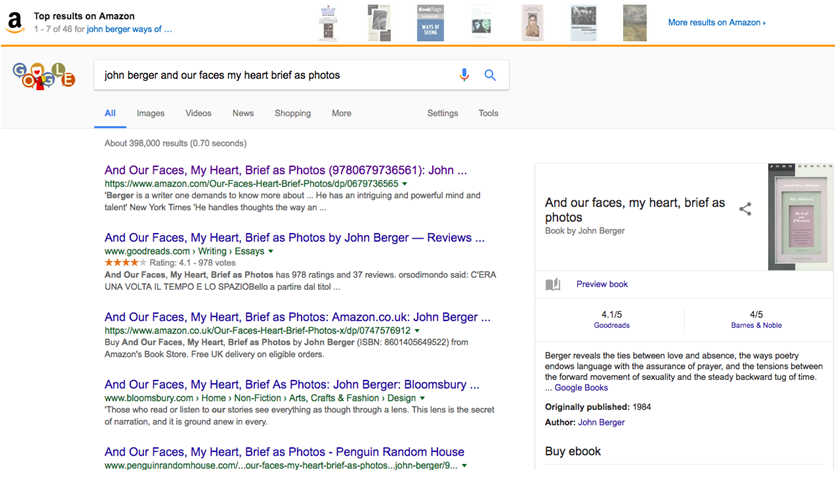

Even a much less commercial query returns this option to purchase from Amazon:

It is noteworthy that while no advertisers are bidding on the term [john berger and our faces my heart brief as photos] via Google, Amazon’s search engine has a match for the query and, therefore, it shows an ad above the Google results.

I have seen this occur for about a month now (on other, less obscure queries) and, even if Google moves to shut this down in future, it is a clear and overt statement of intent from Amazon.

A look at the terms and conditions for the Amazon Assistant reveals how this is happening.

The list of information gathered by Amazon is extensive (to the extent of being troubling) and includes the following statement:

“We will collect and store information such as the name and price of the product, the webpage on which the item is sold, your Amazon account, your search query, and other information.”

Nested in there is the operative phrase “your search query”. By capturing a search query, Amazon can cross-reference its own inventory to see whether there is a match and dynamically serve the available options.

The aim, evidently, is to create an ‘all roads lead to Amazon’ approach within e-commerce, and the only way to do that right now is to take market share directly from Google and other retailers.

Strategically, this makes a lot of sense. Each of the main players would love to have a self-enclosed ecosystem that houses billions of users and all of their accompanying data.

Only Facebook can lay even tenuous claim to such a lofty ambition, so for the likes of Pinterest and Amazon there is no other option than to reach beyond their own platforms and observe, ready for the opportune moment to communicate with consumers.

Amazon, therefore, has adopted the assumption that consumers will swallow any level of intrusion into their data and their online experience if they ultimately end up with a better deal on products.

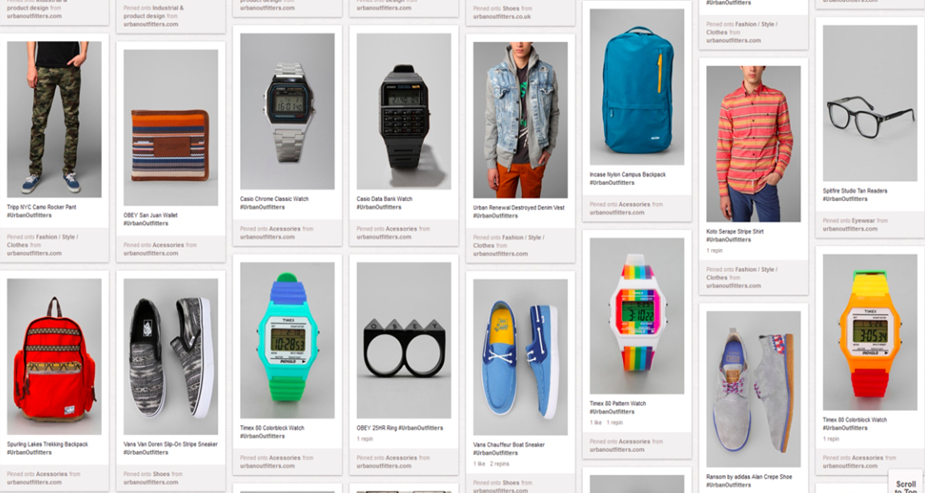

Pinterest has a rather different market position, user base, and approach to search. So how do these take shape within their revamped Chrome extension?

Pinterest save button

We have written about the advances in visual search taking place on Pinterest recently, but use of that technology is of course dependent on people visiting their site initially to conduct a search.

What the browser extension can now become is a vehicle to carry that technology to a much wider arena, to any site Pinterest users (or ‘Pinners’) visit.

In their blog post announcing the launch, Pinterest stated that the latest iteration of their Chrome extension will allow consumers to conduct a visual search using any image or webpage they visit.

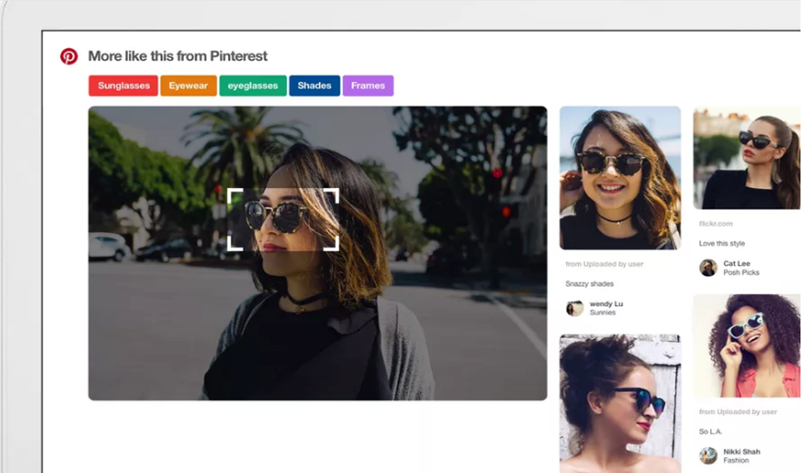

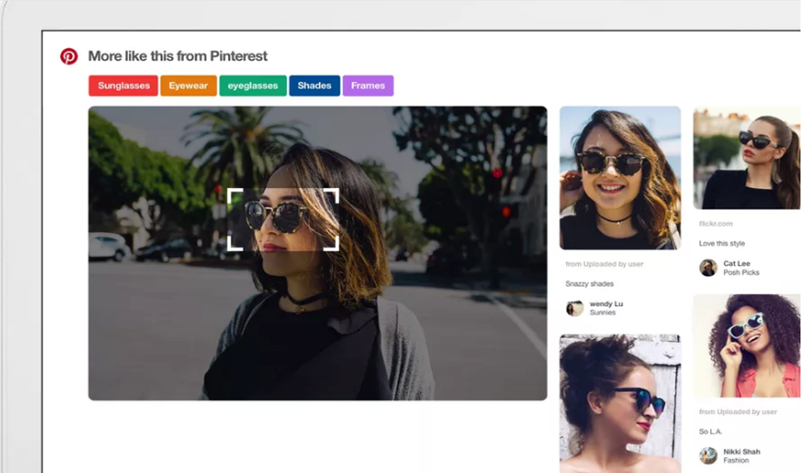

The screenshot below is an example of this in action, with a user selecting the sunglasses within the image and Pinterest suggesting a variety of similar products to browse:

This provides access to Pinterest’s vast database of images and its industry-leading image recognition software, without even having to visit the Pinterest site. All of this occurs while the user stays on the original web page, only moving them to Pinterest if they click on one of the suggested images.

Another striking aspect of the blog post comes in this statement:

“Now anything you see on Pinterest, or capture with the camera in your Pinterest app, can kick off a search for great ideas—all without typing a single character.”

The business strategy here is not to tackle Google head on à la Amazon, but rather to engage users before they even know what they want to type. As such, the aim is to offer a different experience altogether, driven uniquely by images.

When we think of search, we think of Google, paid ads, and ten blue links. But by stepping into an area that pre-dates those steps in a consumer’s mind, Pinterest may find a niche that Google has not yet managed to tap into just yet.

The language used in the announcement is notable too, if we compare Amazon and Pinterest; in place of ‘products’, read ‘ideas’, for example. This is a subtle but telling distinction, with Pinterest looking to claim the more aspirational ground within the e-commerce search market.

Pinterest’s new visual search functionality will extend to other browser extensions “soon” and will allow brands to opt out, but Pinterest is of course hoping that the mutual benefits will outweigh the inconveniences for retailers. As is the case with Amazon, the force of consumer demand will ultimately drive (or halt) the extension’s adoption and acceptance.

What should marketers make of this?

Competition breeds innovation and search has been close to a monopoly for too long, in that sense. Google evolves and new products are rolled out constantly, but these are often tantamount to slightly bigger versions of the PPC ads we had yesterday, or an increasingly inconspicuous ‘Ad’ label.

Competition also increases scarcity, of course, and scarcity drives up prices. We have seen this with Google CPC prices and more recently on Facebook, so the diversification of options for advertisers could help to stem that tide.

Pinterest’s global head of partnerships, Jon Kaplan, has even been quoted recently saying, “You might see a pretty steep discount”, when comparing their inventory prices to Facebook or Google.

The possibility of another major player in this arena, be it Amazon, Pinterest, or both, should therefore be welcomed by consumers and advertisers alike. By everyone except Google and Facebook, in fact.